Investing in yourself is one of the most effective strategies to achieve financial success and personal growth. Unlike material possessions, self-investment yields continuous returns over a lifetime. Whether you’re just starting out on your financial journey or looking to optimize your current strategies, this guide will provide you with twenty actionable ways to build wealth. Let’s dive in and explore these methods.

1. Prioritize Education and Lifelong Learning

One of the most significant investments you can make is in your education. Continually upgrading your skills and knowledge can open doors to new opportunities and higher earning potential. This doesn’t mean you have to go back to school full-time; online courses, certifications, workshops, and even reading books on relevant subjects can greatly enhance your expertise.

2. Develop a Strong Financial Plan

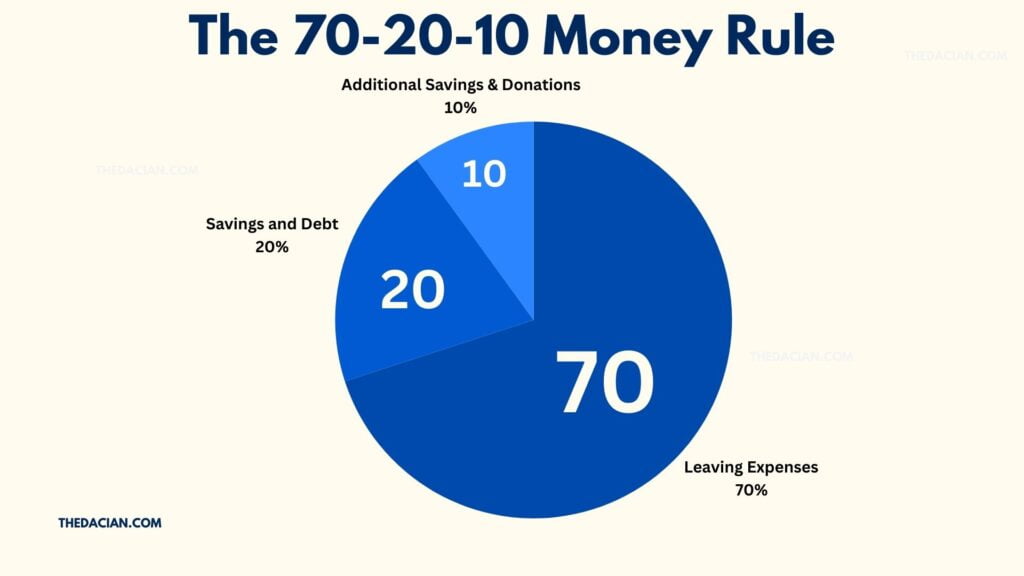

Creating a comprehensive financial plan is crucial for wealth building. This plan should include budgeting, saving, investing, and debt management strategies. By setting clear financial goals and tracking your progress, you can make informed decisions that align with your long-term objectives.

3. Invest in Your Health

Good health is the foundation of a productive and fulfilling life. Regular exercise, a balanced diet, and adequate sleep can significantly improve your physical and mental well-being. Investing in health insurance and regular check-ups can also prevent costly medical expenses in the future.

4. Cultivate a Growth Mindset

A growth mindset is the belief that your abilities and intelligence can be developed through dedication and hard work. This perspective encourages resilience, a willingness to learn from failure, and a proactive approach to challenges. Embracing a growth mindset can lead to personal and professional growth, ultimately contributing to your wealth-building journey.

5. Build a Professional Network

Networking is an invaluable tool for career advancement and business opportunities. Attend industry conferences, join professional organizations, and connect with mentors who can offer guidance and support. A strong professional network can provide insights, referrals, and collaborations that can enhance your career and financial prospects.

6. Enhance Your Income Streams

Relying on a single source of income can be risky. Diversifying your income streams can provide financial stability and increase your wealth. Consider side hustles, freelance work, passive income through investments, or starting a small business. Multiple income streams can also offer a safety net during economic downturns.

7. Invest in Real Estate

Real estate is a proven avenue for building wealth. Property values tend to appreciate over time, and rental income can provide a steady cash flow. Research different types of real estate investments, such as residential, commercial, or REITs (Real Estate Investment Trusts), to find the best fit for your financial goals.

8. Save and Invest Regularly

Consistent saving and investing are fundamental to wealth accumulation. Aim to save a portion of your income each month and invest in diversified portfolios. Compounding interest and the power of time can significantly grow your investments. Utilize retirement accounts like 401(k)s or IRAs to benefit from tax advantages.

9. Develop Valuable Skills

Acquiring high-demand skills can enhance your career prospects and earning potential. Focus on skills that are relevant to your industry or consider learning new ones that can open doors to different career paths. Technical skills, leadership abilities, and emotional intelligence are highly sought after in today’s job market.

10. Manage Debt Wisely

Debt can be a double-edged sword. While some debt, like mortgages or student loans, can be beneficial, high-interest debt such as credit cards can hinder your financial progress. Develop a strategy to pay off high-interest debts as quickly as possible while managing and leveraging good debt to your advantage.

11. Practice Mindful Spending

Being mindful of your spending habits is essential for building wealth. Create a budget that aligns with your financial goals and track your expenses to identify areas where you can cut back. Prioritize spending on necessities and experiences that add value to your life, and avoid unnecessary luxuries that can drain your resources.

12. Give Back to Your Community

Investing in your community can also be a way to build wealth. Philanthropy and volunteering can enrich your life and create a sense of purpose. Supporting local businesses, mentoring others, or donating to causes you care about can strengthen community ties and potentially lead to new opportunities.

13. Cultivate a Positive Attitude

A positive attitude can significantly impact your journey to wealth. Optimism and a can-do attitude can help you overcome obstacles and maintain motivation. Surround yourself with positive influences, practice gratitude, and focus on your strengths. A positive mindset can attract opportunities and improve your overall well-being.

14. Stay Informed on Financial Trends

Keeping up-to-date with financial news and trends is crucial for making informed investment decisions. Subscribe to reputable financial publications, follow market analysts, and participate in financial forums. Being informed can help you anticipate market changes and adapt your investment strategies accordingly.

15. Invest in Technology

Technology is rapidly evolving, and staying ahead of the curve can provide a competitive advantage. Invest in tools and software that enhance your productivity and efficiency. Whether it’s project management software, automation tools, or financial planning apps, leveraging technology can streamline your processes and save time and money.

Related: Investment 7 Year Rule -Everything You Need to Know

16. Improve Time Management Skills

Time is one of your most valuable resources. Learning to manage your time effectively can increase your productivity and allow you to focus on high-priority tasks. Use techniques like time blocking, setting SMART goals, and prioritizing tasks to make the most of your time and achieve your wealth-building objectives.

17. Seek Professional Advice

Consulting with financial advisors, accountants, and other professionals can provide valuable insights and guidance. These experts can help you develop tailored strategies, identify investment opportunities, and avoid common pitfalls. Their expertise can be instrumental in optimizing your financial plan and accelerating your wealth-building journey.

18. Build an Emergency Fund

An emergency fund acts as a financial safety net, protecting you from unexpected expenses. Aim to save three to six months’ worth of living expenses in a readily accessible account. Having an emergency fund can provide peace of mind and prevent you from derailing your financial goals in times of crisis.

19. Focus on Personal Development

Investing in personal development can enhance your skills, knowledge, and overall quality of life. Attend workshops, read self-help books, and practice self-reflection. Personal development can boost your confidence, improve your decision-making abilities, and contribute to your overall success.

20. Set Clear and Achievable Goals

Setting clear and achievable goals is essential for staying focused and motivated. Break down your long-term objectives into smaller, manageable steps. Track your progress and celebrate your achievements along the way. Clear goals provide direction and a sense of purpose, driving you towards your wealth-building aspirations.

Conclusion

Investing in yourself is a holistic approach to building wealth that goes beyond mere financial gains. By prioritizing education, health, a growth mindset, and strong financial strategies, you set the stage for long-term success. Remember, the journey to wealth is not just about accumulating money but also about enhancing your overall quality of life. Start today, take consistent steps, and watch your investments in yourself pay off in ways you never imagined.

Created with AIPRM Prompt “Written SEO Article | 100% Human Content Score | Keyword-Rich Content”

Frequently Asked Questions

1. Why is investing in yourself important for building wealth?

Investing in yourself is crucial for building wealth because it enhances your skills, knowledge, and overall well-being. These improvements can lead to higher earning potential, better financial decision-making, and a more fulfilling life. Personal growth and self-investment create a solid foundation for long-term financial success.

2. What are some ways to diversify income streams?

Diversifying income streams can involve pursuing side hustles, freelancing, investing in real estate or stocks, and starting a small business. This strategy helps mitigate financial risk and provides multiple sources of revenue, enhancing financial stability and growth opportunities.

3. How can I start saving and investing regularly?

Start by creating a budget that prioritizes saving a portion of your income each month. Set up automatic transfers to savings and investment accounts. Choose diversified investment options like mutual funds, stocks, or retirement accounts (401(k), IRA) to benefit from compound interest over time.

4. What is the role of a growth mindset in wealth building?

A growth mindset is the belief that you can develop your abilities through dedication and hard work. This perspective encourages resilience, continuous learning, and proactive problem-solving. Embracing a growth mindset can lead to personal and professional growth, which is essential for building wealth.

5. How can I effectively manage and reduce debt?

To effectively manage and reduce debt, start by prioritizing high-interest debt payments. Create a repayment plan, cut unnecessary expenses, and avoid accumulating new debt. Consider consolidating loans or negotiating lower interest rates. Managing debt wisely can improve your financial health and increase your wealth-building potential.

Related: What are Investable Assets