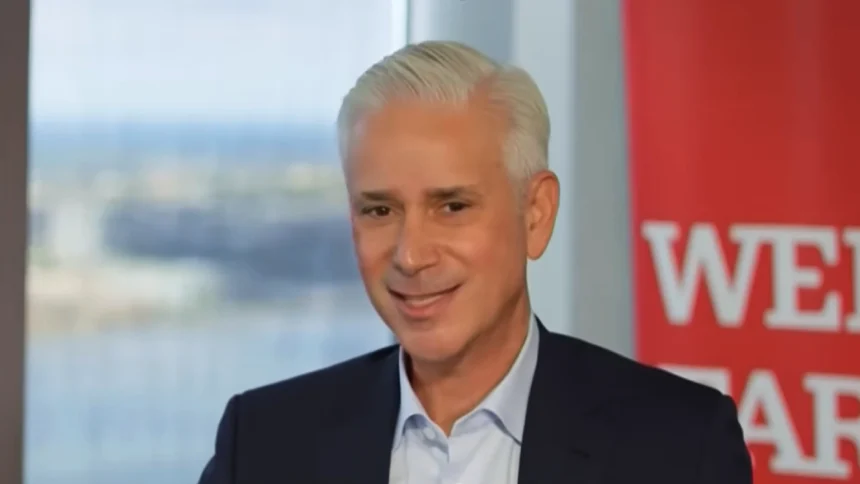

Charles Scharf, the Chief Executive Officer of Wells Fargo & Company, stands as one of the most influential figures in American banking. With decades of experience and leadership roles in some of the nation’s top financial institutions, his wealth is a reflection of his longstanding dedication and prowess in the financial world. In this comprehensive article, we take a deep dive into Charles Scharf net worth, career milestones, income sources, investments, and more.

Who Is Charles Scharf?

Charles W. Scharf, born in 1965, is a renowned American banker and business executive. He currently serves as the CEO and President of Wells Fargo, one of the largest banks in the United States by total assets. Before assuming this role in 2019, Scharf held high-profile positions at industry giants such as Visa Inc., JPMorgan Chase, Citigroup, and Bank One.

Scharf’s professional journey is marked by a strong track record of operational excellence, strategic vision, and a commitment to regulatory compliance, which made him a prime choice for steering Wells Fargo through its most challenging periods.

Charles Scharf Net Worth in 2025

As of 2025, Charles Scharf net worth is estimated to be between $75 million and $100 million. This estimation includes his accumulated wealth from base salary, stock options, bonuses, and long-term incentive plans over the years.

Here is a breakdown of the sources contributing to his net worth:

1. Base Salary and Annual Compensation

Charles Scharf’s base salary as the CEO of Wells Fargo is approximately $2.5 million per year. However, this is only a fraction of his total compensation. His annual earnings often soar beyond $24 million, thanks to performance-based bonuses, equity grants, and other financial incentives.

2. Stock Options and Equity Awards

A major portion of Scharf’s net worth comes from his equity compensation. As of recent filings with the U.S. Securities and Exchange Commission (SEC), Scharf holds millions of dollars in Wells Fargo stock. In 2023 alone, he received over $18 million in stock awards, aligning his interests closely with those of shareholders.

3. Other Executive Perks

In addition to salary and equity, Scharf enjoys numerous executive benefits, including:

- Deferred compensation plans

- Use of corporate aircraft

- 401(k) contributions

- Executive health and wellness packages

Career Highlights That Built His Wealth

Early Career and JPMorgan Chase

Charles Scharf began his career working under Jamie Dimon at Commercial Credit Corporation, which later became part of Citigroup. His early mentorship under Dimon helped shape his leadership style. At JPMorgan Chase, he served as CEO of the Retail Financial Services division, overseeing one of the largest banking operations in the country.

CFO of Citigroup’s Global Corporate and Investment Bank

Scharf served as Chief Financial Officer at Citigroup’s Investment Bank, one of the most prestigious roles in global finance. This position boosted both his reputation and compensation, solidifying his place among the elite Wall Street executives.

CEO of Visa Inc.

From 2012 to 2016, Charles Scharf served as the CEO of Visa, the world’s leading digital payments company. Under his leadership, Visa’s market cap surged, and its global expansion accelerated. During this period, Scharf’s net worth experienced significant growth, as he received lucrative equity and performance bonuses.

CEO of BNY Mellon

After a brief hiatus, Scharf returned to banking as the CEO of Bank of New York Mellon in 2017. Although his tenure here was relatively short, he made impactful changes and further solidified his leadership brand, contributing to his overall financial growth.

Leadership at Wells Fargo

In October 2019, Scharf took over as CEO of Wells Fargo, following a series of scandals that had tainted the bank’s reputation. His arrival was viewed as a turning point, and the bank’s board offered him a competitive compensation package to reflect the gravity of the role and the expectations for a cultural transformation.

Charles Scharf’s Investment Portfolio

In addition to his executive earnings, Charles Scharf has a well-diversified investment portfolio, which includes:

- Real estate holdings in upscale neighborhoods in New York and California

- Stocks and mutual funds outside of Wells Fargo equity

- Private equity and venture capital investments

- Charitable foundations and trusts, which offer tax-advantaged wealth management strategies

Scharf is also known for making philanthropic contributions. Often donating through foundations and educational programs, signaling a commitment to social responsibility.

Real Estate and Lifestyle

Though not as flamboyant as other executives, Scharf maintains a luxurious but relatively low-profile lifestyle. His known real estate assets include:

- A multi-million-dollar residence in Manhattan

- A private estate in the San Francisco Bay Area

- Investment properties in Palm Beach and Los Angeles

Despite his wealth, Scharf is often described as a disciplined and focused executive, choosing to invest in long-term assets rather than public displays of wealth.

How Charles Scharf Compares to Other Banking CEOs

When placed side by side with peers such as Jamie Dimon (JPMorgan Chase), Brian Moynihan (Bank of America), and David Solomon (Goldman Sachs), Charles Scharf’s compensation and net worth are in the upper tier of the industry.

| CEO | Bank/Company | Estimated Net Worth (2025) | Annual Compensation |

|---|---|---|---|

| Charles Scharf | Wells Fargo | $75M – $100M | ~$24M |

| Jamie Dimon | JPMorgan Chase | $1.8B+ | ~$36M |

| Brian Moynihan | Bank of America | $120M – $150M | ~$23M |

| David Solomon | Goldman Sachs | ~$85M | ~$25M |

Conclusion: A Wealth Built on Strategic Leadership

Charles Scharf’s net worth is a testament to decades of successful leadership in the financial sector. From his early days under Jamie Dimon to his current efforts at revamping Wells Fargo, Scharf’s career has been marked by consistent performance, strategic decision-making, and financial stewardship.

As he continues to lead Wells Fargo into a new era of compliance, innovation, and customer trust, his financial legacy is expected to grow even further, placing him among the most respected and well-compensated executives in modern banking.

FAQs

1. What is Charles Scharf net worth in 2025?

Charles Scharf net worth is estimated between $75 million and $100 million as of 2025, primarily from salary, stock awards, and investments.

2. How much does Charles Scharf earn annually as Wells Fargo CEO?

He earns approximately $24 million annually, including a $2.5 million base salary, bonuses, and stock-based compensation.

3. What are the main sources of Charles Scharf’s wealth?

His wealth comes from executive salaries, equity in Wells Fargo, investments, and his leadership roles at Visa, JPMorgan, and BNY Mellon.

4. Does Charles Scharf own any real estate?

Yes, he owns multiple luxury properties in New York, California, and Florida, contributing to his substantial net worth.

5. How does Charles Scharf’s net worth compare to other banking CEOs?

While not the highest, his net worth places him among the top U.S. banking executives, closely behind Jamie Dimon and Brian Moynihan.

Read Also: Side Hustles for Stay-at-Home Moms: Making Money from Home