When we talk about personal finance, liquid net worth is a term that often gets mentioned, but many people may not fully understand what it means or why it’s important. In essence, liquid net worth represents the portion of your total net worth that can be quickly converted into cash, providing a clearer picture of your true financial standing.

Unlike total net worth, which includes all assets such as real estate, retirement accounts, and other investments, liquid net worth focuses solely on assets that are easily accessible and can be converted to cash with minimal impact on their value. This article will break down the concept of liquid net worth, why it matters, how to calculate it, and strategies to improve it.

Understanding Liquid Assets

To grasp the concept of liquid net worth, it’s essential first to understand what liquid assets are. Liquid assets are those that can be swiftly converted into cash with little to no loss in value. The most common examples of liquid assets include:

- Cash: This is the most liquid asset as it is already in its most accessible form.

- Checking and savings accounts: Money in these accounts can be easily withdrawn or transferred.

- Money market accounts: These are similar to savings accounts but may offer better interest rates.

- Stocks and bonds: While stocks and bonds can generally be sold quickly, their value can fluctuate, affecting their liquidity.

- Mutual funds and ETFs: These can also be liquidated relatively easily, though like stocks and bonds, their value may vary.

On the other hand, assets like real estate, collectibles, or retirement accounts are not considered liquid because they cannot be quickly sold or converted into cash without potentially losing significant value.

Calculating Liquid Net Worth

Calculating your liquid net worth is a straightforward process that involves summing up all of your liquid assets and then subtracting your liabilities. Here’s a step-by-step guide to doing so:

1. List All Liquid Assets

Start by listing all of your liquid assets. This includes the cash you have on hand, the balances in your checking and savings accounts, the market value of your stocks, bonds, mutual funds, and any other assets that can be quickly converted into cash.

2. Determine the Value of Each Asset

Next, determine the current market value of each of these assets. For bank accounts, this is simply the current balance. For investments, this would be the current market price.

3. Add Up Liquid Assets

Once you have the value of each liquid asset, add them all together to get your total liquid assets.

4. Subtract Liabilities

Liabilities are debts or financial obligations that you owe. This can include credit card debt, personal loans, and other forms of debt. Subtract your total liabilities from your total liquid assets. The result is your liquid net worth.

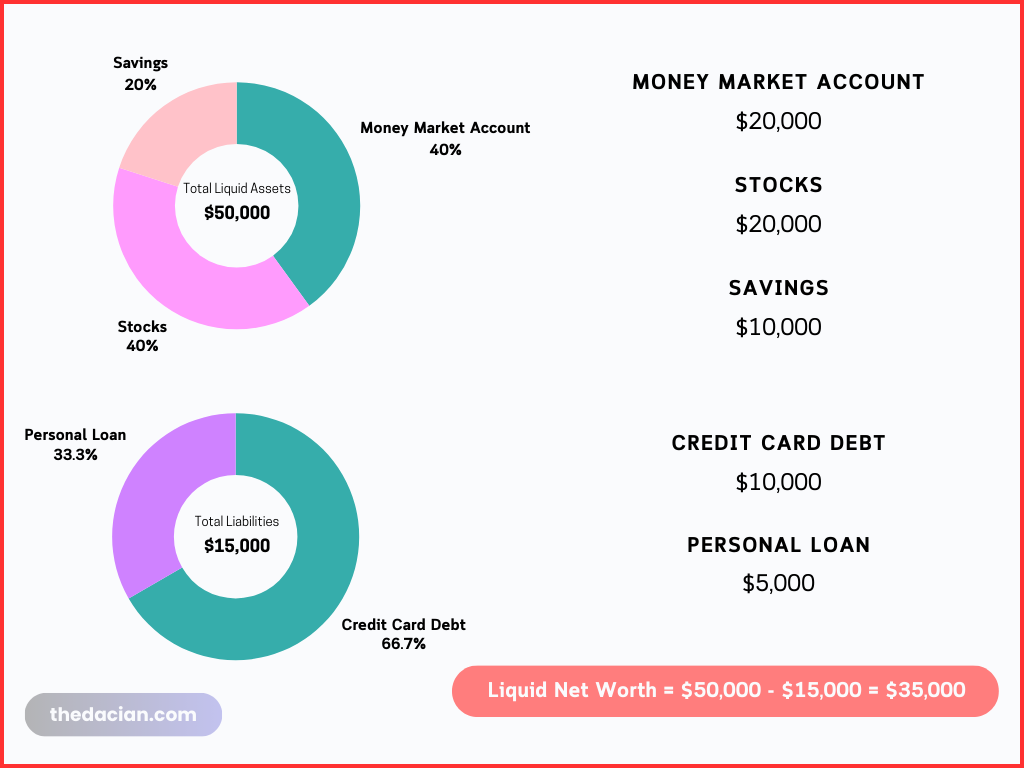

Example Calculation:

- Total Liquid Assets: $50,000 (including $10,000 in savings, $20,000 in stocks, and $20,000 in a money market account)

- Total Liabilities: $15,000 (including $10,000 in credit card debt and $5,000 in personal loans)

Liquid Net Worth = $50,000 – $15,000 = $35,000

In this example, the individual’s liquid net worth is $35,000.

Why Liquid Net Worth Matters

Liquid net worth is a crucial indicator of financial health because it represents the amount of money you have readily available to cover expenses, handle emergencies, or take advantage of opportunities. Unlike total net worth, which can be misleading if most of your wealth is tied up in illiquid assets like real estate or retirement accounts, liquid net worth gives a clearer picture of your immediate financial situation.

Emergency Preparedness

Having a solid liquid net worth is vital for emergency preparedness. If an unexpected expense arises, such as a medical emergency or urgent home repair, you need to be able to access funds quickly. If most of your net worth is in illiquid assets, you might struggle to come up with the necessary cash without selling assets at a loss or incurring debt.

Investment Opportunities

A high liquid net worth also provides the flexibility to seize investment opportunities as they arise. Whether it’s buying stocks during a market dip or investing in a new business venture, having liquid assets on hand allows you to act quickly and potentially increase your wealth.

Debt Management

Monitoring your liquid net worth can also help in managing and reducing debt. By keeping a close eye on your liquid assets and liabilities, you can make informed decisions about paying off high-interest debts or reallocating resources to improve your financial position.

Strategies to Improve Liquid Net Worth

Improving your liquid net worth involves increasing your liquid assets and/or reducing your liabilities. Here are some strategies to help you achieve that:

1. Build an Emergency Fund

An emergency fund is a reserve of cash or liquid assets that you can draw upon in case of unexpected financial needs. Aim to save at least three to six months’ worth of living expenses in a high-yield savings account or money market account.

2. Pay Down High-Interest Debt

High-interest debt, such as credit card debt, can quickly erode your liquid net worth. Focus on paying off these debts as quickly as possible to reduce your liabilities and increase your overall net worth.

3. Increase Contributions to Liquid Investments

Consider allocating more of your savings to liquid investments, such as stocks, bonds, or ETFs. While these investments may fluctuate in value, they offer the potential for growth while still being relatively easy to liquidate if needed.

4. Avoid Over-Investing in Illiquid Assets

While it’s important to have a diversified portfolio, be cautious about over-investing in illiquid assets like real estate or retirement accounts. These can be valuable in the long term but may not be helpful in a financial emergency.

5. Regularly Review and Adjust Your Financial Plan

Your financial situation can change over time, so it’s important to regularly review your liquid net worth and make adjustments to your financial plan as needed. This might involve reallocating investments, adjusting savings goals, or paying down debt.

Conclusion

Understanding and managing your liquid net worth is crucial for maintaining financial stability and preparing for the unexpected. By focusing on building liquid assets and reducing liabilities, you can improve your financial flexibility and position yourself to take advantage of opportunities as they arise. Regularly monitoring your liquid net worth and making strategic adjustments to your financial plan can help you achieve long-term financial success.

Related: 20 Ways to Build Wealth

QNAs

Here are five of the most searched questions on the internet, along with detailed answers:

1. What is liquid net worth?

Liquid net worth is the portion of your total net worth that can be quickly converted into cash without significantly affecting its value. It includes assets like cash, checking and savings accounts, stocks, bonds, and other investments that are easily accessible. Liquid net worth provides a clearer picture of your immediate financial health compared to total net worth, which includes less accessible assets like real estate or retirement accounts.

2. How do I calculate my liquid net worth?

To calculate your liquid net worth, follow these steps:

- List all your liquid assets, such as cash, savings, and easily sellable investments like stocks.

- Determine the current value of each of these assets.

- Add up the total value of these liquid assets.

- Subtract your liabilities (debts or financial obligations) from this total.

The result is your liquid net worth, representing the amount of money you could quickly access if needed.

3. Why is liquid net worth important?

Liquid net worth is important because it reflects your financial flexibility and ability to handle emergencies or unexpected expenses. While total net worth includes all assets, liquid net worth focuses on assets that can be quickly converted to cash, providing a more accurate picture of your financial readiness. A higher liquid net worth means you are better prepared to cover immediate needs without needing to sell long-term investments or borrow money.

4. What assets are considered liquid for liquid net worth?

Assets considered liquid for calculating liquid net worth include:

- Cash on hand

- Balances in checking and savings accounts

- Stocks, bonds, and mutual funds that can be sold quickly

- Money market accounts

- Certificates of deposit (CDs) with short maturity periods

- Short-term government bonds

These assets can be easily converted into cash with minimal loss of value, making them a crucial part of your liquid net worth.

5. How can I increase my liquid net worth?

You can increase your liquid net worth by:

- Building an emergency fund in a high-yield savings account.

- Paying down high-interest debt, which reduces liabilities.

- Investing in liquid assets like stocks, bonds, and money market accounts.

- Avoiding over-investment in illiquid assets like real estate, which can tie up your funds.

- Regularly reviewing and adjusting your financial plan to ensure you maintain a healthy balance of liquid assets relative to your overall financial goals.

Related: Philanthropic Financial Planning