Best FREE and simple easy-to-use Retirement Calculator for calculating the estimated number of $ you save.

Retirement Calculator

Mastering Your Retirement Planning with a Retirement Calculator

Retirement planning is one of the most crucial financial strategies you will undertake in your life. The decisions you make now will determine your financial stability and quality of life in your golden years. One of the most effective tools to assist in this process is a retirement calculator. This comprehensive guide will walk you through how to use a retirement calculator, the benefits it offers, and answer some frequently asked questions to help you maximize your retirement planning.

What is a Retirement Calculator?

A retirement calculator is an online tool designed to help you estimate how much money you will need to save to retire comfortably. It takes into account various factors such as your current age, retirement age, monthly savings, expected rate of return on investments, and future expenses. By inputting these variables, the calculator provides an estimate of the total savings you will need and how much you should save each month to reach your retirement goals.

How to Use a Retirement Calculator

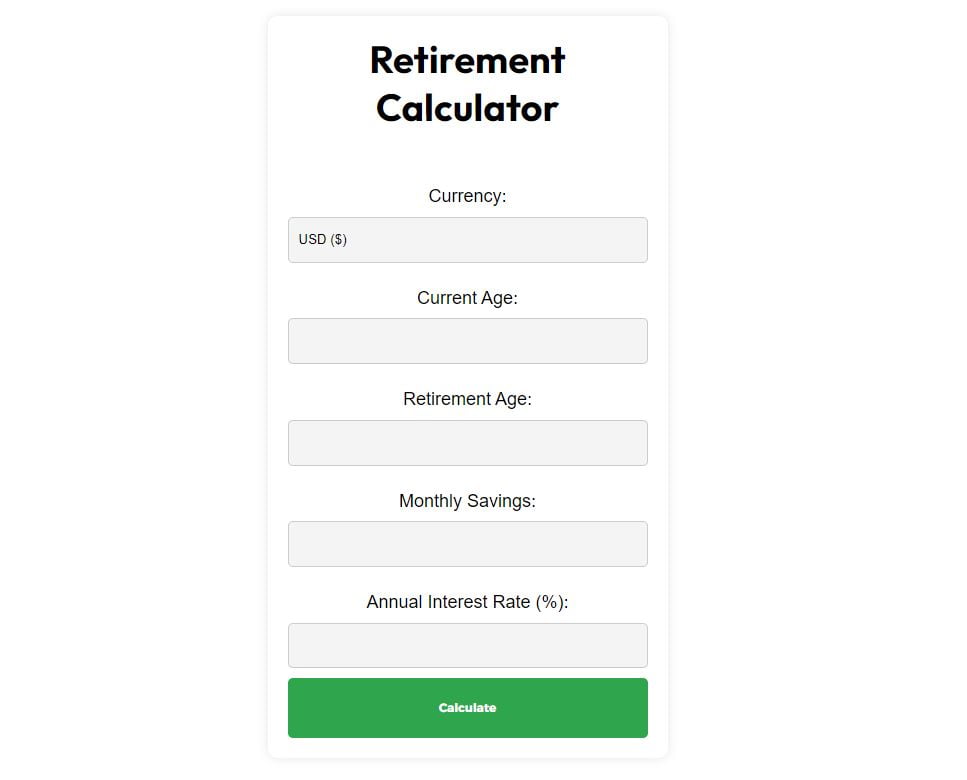

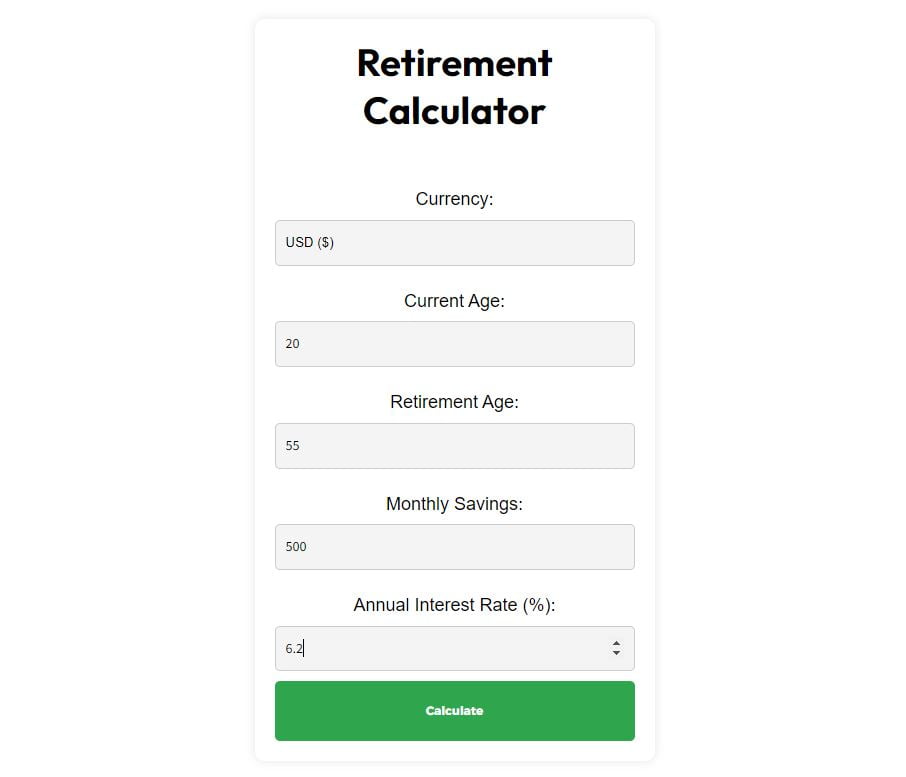

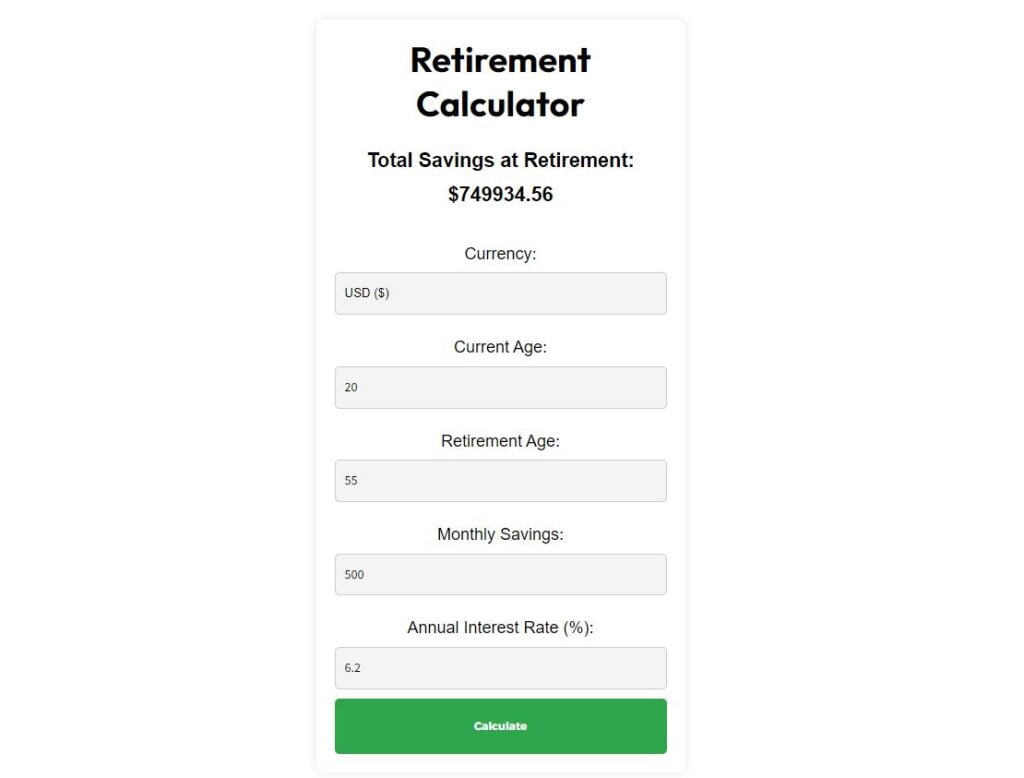

Using a retirement calculator is straightforward. Here’s a step-by-step guide:

Enter Your Current Age and Retirement Age: Input your current age and the age at which you plan to retire. This helps the calculator determine the time horizon for your savings.

Input Your Monthly Savings: Enter the amount you currently save each month towards your retirement. This includes contributions to retirement accounts like 401(k)s, IRAs, and other savings vehicles.

Estimate Your Annual Interest Rate: Provide an estimated annual return on your investments. This is typically based on the historical returns of your investment portfolio.

Select Your Currency: Choose the currency in which you want the results to be displayed.

Calculate Your Results: Click the calculate button to see your results. The calculator will show you the estimated total savings at retirement and how much more you need to save each month to reach your goals.

Benefits of Using a Retirement Calculator

1. Personalized Financial Planning

A retirement calculator provides personalized estimates based on your specific financial situation. By inputting your own data, you get a tailored plan that reflects your unique retirement goals and current financial status.

2. Goal Setting

Using a retirement calculator helps you set realistic retirement goals. It gives you a clear picture of how much you need to save and allows you to make informed decisions about your retirement strategy.

3. Identifying Savings Gaps

The calculator highlights any shortfalls in your current savings plan. By identifying these gaps early, you can take corrective actions, such as increasing your savings rate or adjusting your investment strategy.

4. Stress Testing

You can use a retirement calculator to stress test your retirement plan under different scenarios. For example, you can see how changes in investment returns, inflation rates, or unexpected expenses impact your retirement savings.

5. Ease of Use

Retirement calculators are user-friendly and accessible. Most are available online for free, making it easy for anyone to start planning for their retirement without needing extensive financial planning.

Tips for Maximizing Your Retirement Savings Using a Calculator

- Start Early: The sooner you start saving, the more time your money has to grow. Use the calculator to set early savings goals and take advantage of compound interest.

- Increase Savings Gradually: As your income grows, try to increase your retirement savings rate. Even small increases can have a significant impact over time.

- Diversify Investments: A well-diversified investment portfolio can help manage risk and optimize returns. Use the calculator to see how different investment returns impact your savings.

- Plan for Healthcare Costs: Healthcare is a major expense in retirement. Factor in expected healthcare costs to ensure you have sufficient savings.

- Recalculate Regularly: Regularly update your retirement plan using the calculator to account for changes in your financial situation and goals.

Conclusion

A retirement calculator is a powerful tool that can significantly enhance your retirement planning process. By providing personalized estimates and helping you set realistic goals, it empowers you to take control of your financial future. Remember to use the calculator regularly, adjust your plan as needed, and consult with a financial advisor to ensure a comprehensive approach to your retirement planning. Start using a retirement calculator today to pave the way for a comfortable and secure retirement.

Final Thoughts

Planning for retirement is a journey that requires careful consideration and proactive management. With the help of a retirement calculator, you can navigate this journey with confidence and clarity. By understanding your financial needs, setting achievable goals, and staying committed to your savings plan, you can achieve the financial independence and peace of mind you deserve in your golden years. Make the most of this invaluable tool and take the first step towards a well-planned and enjoyable retirement.

QNAs about Retirement Calculator

1. How Accurate Are Retirement Calculators?

Retirement calculators provide estimates based on the information you input and certain assumptions. While they are useful for planning, it’s important to remember that the results are projections and not guarantees. Factors such as changes in the economy, investment returns, and personal circumstances can affect the accuracy of the estimates. Regularly updating your inputs and consulting with a financial advisor can help improve accuracy.

2. Can a Retirement Calculator Account for Inflation?

Yes, many retirement calculators include options to account for inflation. Inflation can significantly impact your purchasing power over time, so it’s crucial to include an inflation rate in your calculations. Typically, you can input an expected inflation rate, and the calculator will adjust your future expenses and savings needs accordingly.

3. What if I Start Saving for Retirement Late?

Starting late means you have less time to save and grow your investments, but it’s never too late to begin. A retirement calculator can help you understand how much you need to save now to catch up. You may need to increase your savings rate, consider working longer, or adjust your retirement lifestyle expectations. Using the calculator helps you create a realistic plan based on your current situation.

4. How Often Should I Use a Retirement Calculator?

It’s a good idea to use a retirement calculator regularly, especially when there are significant changes in your financial situation or retirement goals. Annual reviews are a minimum, but you should also recalculate if you change jobs, get a raise, adjust your retirement age, or make major financial decisions. Regular use helps keep your retirement plan on track.

5. Can I Rely Solely on a Retirement Calculator for My Planning?

While a retirement calculator is an excellent tool for initial planning, it should not be the only resource you rely on. Comprehensive retirement planning involves considering a variety of factors, such as tax implications, healthcare costs, estate planning, and more. Consulting with a financial advisor can provide additional insights and help you create a more robust retirement strategy.