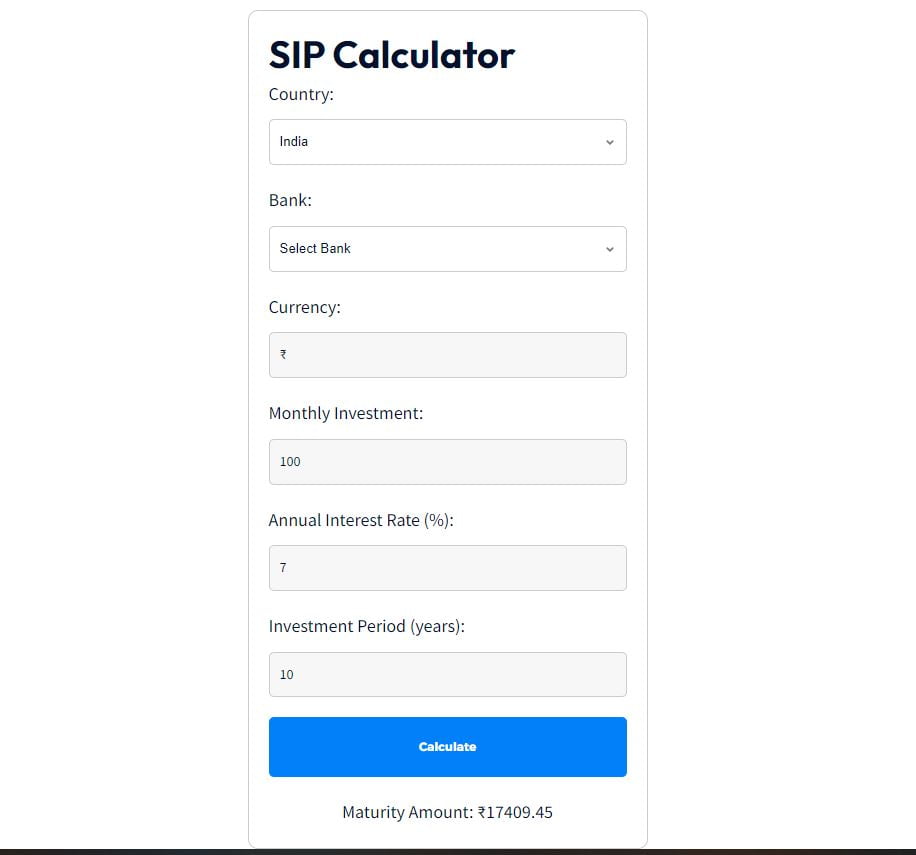

A SIP Calculator tool helps you to find real-time calculations based on Country, Bank, Currency, Monthly Investment, Annual Investment rate(%), and Investment Period (Years).

SIP Calculator

SIP Calculator Tool: Your Ultimate Guide to Systematic Investment Planning

Introduction

Investing is a crucial aspect of financial planning, and one of the most effective methods is through a Systematic Investment Plan (SIP). An SIP allows you to invest a fixed amount regularly in mutual funds, paving the way for wealth creation over time. To assist investors in making informed decisions, we’ve developed an intuitive and easy-to-use SIP Calculator tool. This tool will help you estimate the future value of your investments, making financial planning more straightforward and efficient.

What is a SIP Calculator?

A SIP Calculator is a financial tool designed to help investors calculate the potential returns on their investments through a Systematic Investment Plan. By inputting the monthly investment amount, the expected annual rate of return, and the investment duration, users can quickly determine the maturity amount of their SIP.

Features of Our SIP Calculator Tool

User-Friendly Interface: The SIP calculator is designed with simplicity in mind. Its clean and intuitive interface ensures that even first-time users can navigate it with ease.

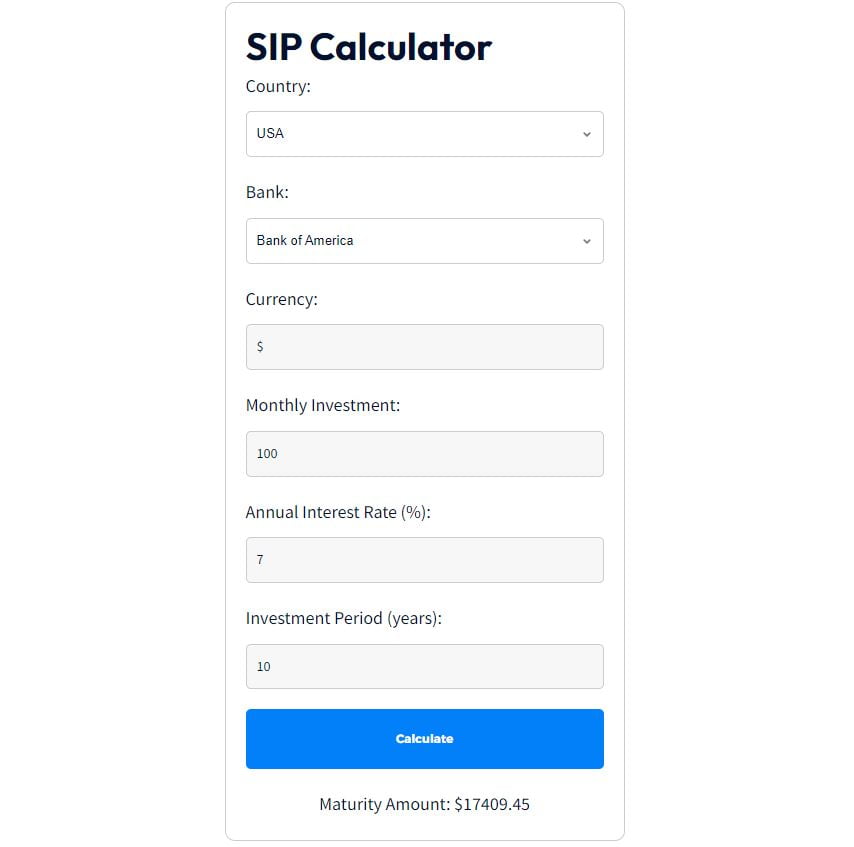

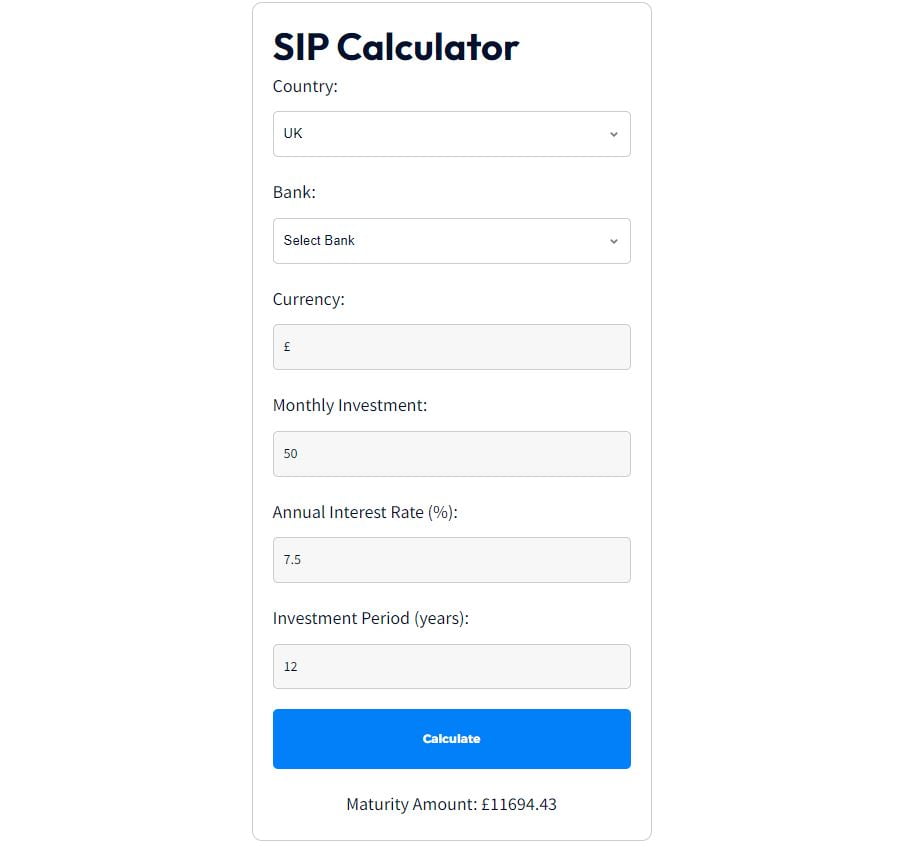

Currency Selection: Our tool supports multiple currencies, including INR, USD, EUR, and GBP, allowing users to calculate returns in their preferred currency.

Country and Bank Selection: Depending on the selected country, users can choose from a list of popular banks, adding another layer of customization to their calculations.

Real-Time Calculations: The SIP calculator provides instant results, helping users make quick and informed decisions about their investments.

Responsive Design: Whether you are accessing the tool from a desktop, tablet, or mobile device, the SIP calculator is fully responsive and provides a seamless user experience.

How to Use the SIP Calculator

Watch Now

Using our SIP Calculator is simple and straightforward. Follow these steps to calculate the maturity amount of your SIP:

- Select Your Country: Choose your country from the dropdown menu. This will automatically update the available banks and the currency used for calculations.

- Choose Your Bank: Select your preferred bank from the list provided.

- Enter the Monthly Investment Amount: Input the amount you plan to invest every month.

- Input the Annual Interest Rate: Enter the expected annual rate of return on your investment.

- Specify the Investment Period: Provide the duration of your investment in years.

- Calculate: Click the “Calculate” button to see the estimated maturity amount of your SIP.

Benefits of Using a SIP Calculator

- Financial Planning: The SIP calculator helps you plan your investments by providing a clear picture of the potential returns, making it easier to set realistic financial goals.

- Time-Saving: Manual calculations can be time-consuming and prone to errors. Our SIP calculator automates the process, delivering accurate results in seconds.

- Investment Comparison: By adjusting the input values, you can compare different investment scenarios and choose the one that best suits your financial objectives.

- Educational Tool: For new investors, the SIP calculator serves as an educational resource, demonstrating the power of compounding and systematic investing.

Why Choose Our SIP Calculator?

- Accuracy: Our tool uses precise algorithms to ensure accurate calculations, giving you confidence in your investment decisions.

- Customizability: The ability to select your country, bank, and currency makes our SIP calculator uniquely customizable to your specific needs.

- Accessibility: With a responsive design, our SIP calculator is accessible from any device, making it convenient for users on the go.

- Comprehensive: The inclusion of various input parameters allows for a detailed and comprehensive analysis of your SIP investments.

Understanding SIP and Its Advantages

A Systematic Investment Plan (SIP) is a disciplined way of investing in mutual funds. Here are some of the key advantages of SIP:

- Disciplined Saving: SIP instills a habit of regular saving, which is essential for wealth creation.

- Rupee Cost Averaging: By investing a fixed amount at regular intervals, you purchase more units when prices are low and fewer units when prices are high, averaging out the cost over time.

- Compounding Returns: SIP benefits from the power of compounding, where the returns generated on your investments are reinvested to generate further returns.

- Flexibility: SIP offers flexibility in terms of investment amount and duration, allowing you to adjust your investments as per your financial goals.

- Convenience: SIP is a hassle-free way of investing, with automatic debits from your bank account, ensuring timely investments without any effort.

Conclusion

Investing through a Systematic Investment Plan (SIP) is a smart and efficient way to achieve your financial goals. Our SIP Calculator tool is designed to make this process even more accessible and straightforward. With features like currency selection, country and bank-specific options, and real-time calculations, our tool stands out as a comprehensive solution for all your SIP calculation needs.

Start planning your investments today with our SIP Calculator and take the first step towards a secure financial future. Whether you’re a seasoned investor or just starting, our tool provides the insights you need to make informed and confident investment decisions.

Frequently Asked Questions (FAQs) About the SIP Calculator Tool

1. What is a SIP Calculator?

Question: What is a SIP calculator, and how does it help investors?

Answer: A SIP calculator is a financial tool designed to help investors estimate the future value of their investments made through a Systematic Investment Plan (SIP). By inputting the monthly investment amount, expected annual return rate, and investment duration, the calculator provides an estimated maturity amount. This helps investors make informed decisions and plan their investments more effectively.

2. How does a SIP Calculator work?

Question: How does the SIP calculator work, and what are the key inputs required?

Answer: The SIP calculator works by using the compound interest formula to calculate the future value of regular investments. The key inputs required are the monthly investment amount, the annual interest rate (expected rate of return), and the investment period (in years). The calculator then computes the estimated maturity amount, considering the power of compounding.

3. Why should I use a SIP Calculator?

Question: Why is it beneficial to use a SIP calculator before starting an investment plan?

Answer: Using a SIP calculator before starting an investment plan offers several benefits:

- Financial Planning: It helps you understand the potential returns, allowing you to set realistic financial goals.

- Time-Saving: It provides quick and accurate calculations, saving you time and effort.

- Investment Comparison: You can compare different investment scenarios by adjusting the inputs.

- Education: It helps new investors understand the impact of systematic investing and compounding.

4. How accurate are the results from a SIP Calculator?

Question: Can I rely on the accuracy of the results provided by the SIP calculator?

Answer: The results from a SIP calculator are based on the input values you provide and use precise mathematical formulas to estimate the maturity amount. While the calculations are accurate, actual returns may vary due to market conditions and changes in interest rates. Therefore, the SIP calculator provides an estimate rather than a guaranteed outcome.

5. Can I use the SIP Calculator for different currencies?

Question: Is the SIP calculator tool adaptable for different currencies?

Answer: Yes, our SIP calculator tool is adaptable for different currencies. You can select your country, and the tool will automatically update the currency used for calculations. This feature allows you to estimate the maturity amount in your preferred currency, making it more convenient for international users.

6. What is the impact of changing the investment period on SIP returns?

Question: How does changing the investment period affect the returns calculated by the SIP calculator?

Answer: The investment period significantly impacts the returns calculated by the SIP calculator. A longer investment period allows more time for the investment to grow and benefit from the power of compounding. Consequently, increasing the investment period typically results in a higher maturity amount, highlighting the importance of long-term investing.

7. Is the SIP Calculator mobile-friendly?

Question: Can I access and use the SIP calculator tool on my mobile device?

Answer: Yes, our SIP calculator tool is fully responsive and mobile-friendly. Whether you access it from a desktop, tablet, or mobile device, the tool provides a seamless user experience. This ensures that you can conveniently calculate your SIP returns on the go, making it easier to manage your investments anytime, anywhere.